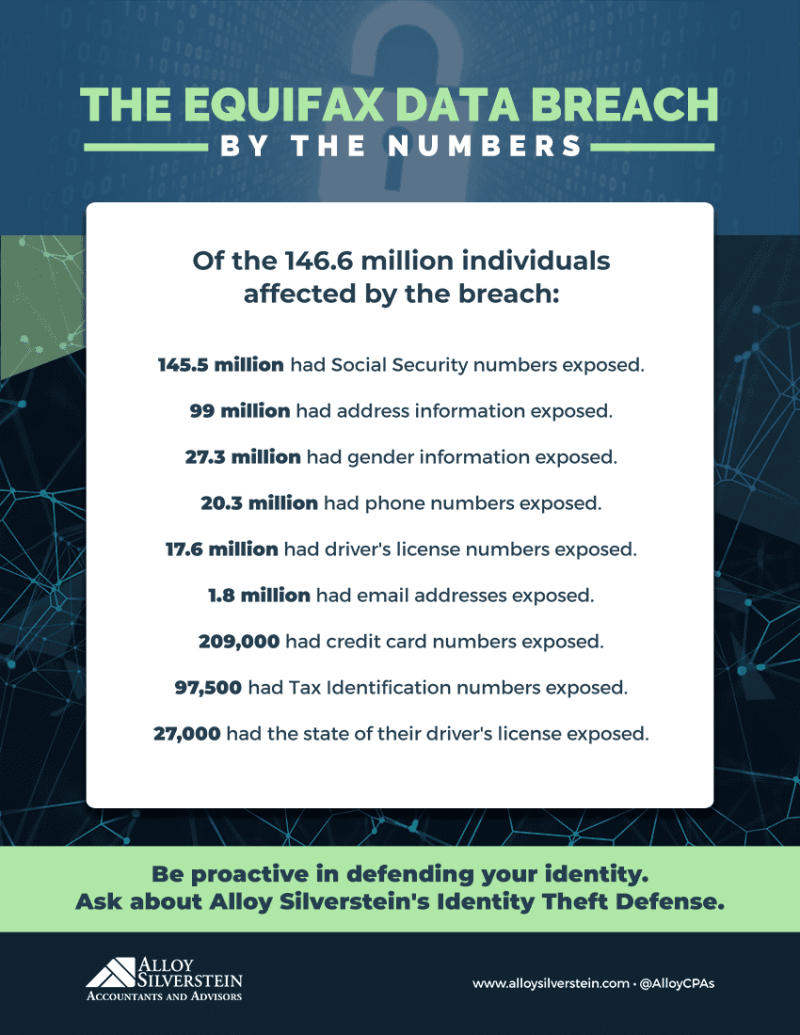

In late 2017, it was reported that the extent of the Equifax data breach was estimated to have impacted 140+ million individuals. Last week the major credit bureau came forward with updated data on the 2017 data breach, revealing the specific types of information that were made vulnerable.

In a statement submitted to the SEC, Equifax reported the following figures:

Odds are that you or one of your family members have already been impacted by the data breach. Unlike credit card theft, if someone has your personal identification information, they can attempt to access and open credit, file fraudulent tax returns, obtain medical care, or commit a crime using your name and identity. Inaction will be costly, so do not wait to become a victim.

First and foremost, review your credit report and all account statements. Consider placing a fraud alert and/or freeze on your credit files to thwart attempts at opening new accounts in your name. Be on the lookout for any mail indicating that “you” have opened a new credit card. If you discover suspicious activity, contact the financial institution(s) affected by the fraudulent act, file a police report, and alert tax authorities that your personal identification information was stolen.

Remain vigilant: Even if you find that you are not a victim of the 2017 Equifax breach, that does not mean your spouse or children are in the clear.

Take precautions and protect yourself today with Alloy Silverstein’s Identity Theft Defense Services.

Learn More

The Equifax Data Breach: What you need to do to protect yourself

Associate Partner

Ren III provides tax, accounting, and advisory services to a broad range of clients, with a specialty for manufacturers, title insurance companies, and professional service providers.

View Ren III's Bio → Follow @R3CPA on Twitter →